1031 tax deferred exchange meaning

You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose allowing you to defer capital. An intercompany transaction is a transaction between corporations that are members of the same consolidated group immediately after the transaction.

12 Situations For Using A Tax Deferred 1031 Exchange Feelings Generation Memories

For 2018 and beyond the TCJA eliminates tax-deferred like-kind exchange treatment for exchanges of personal property.

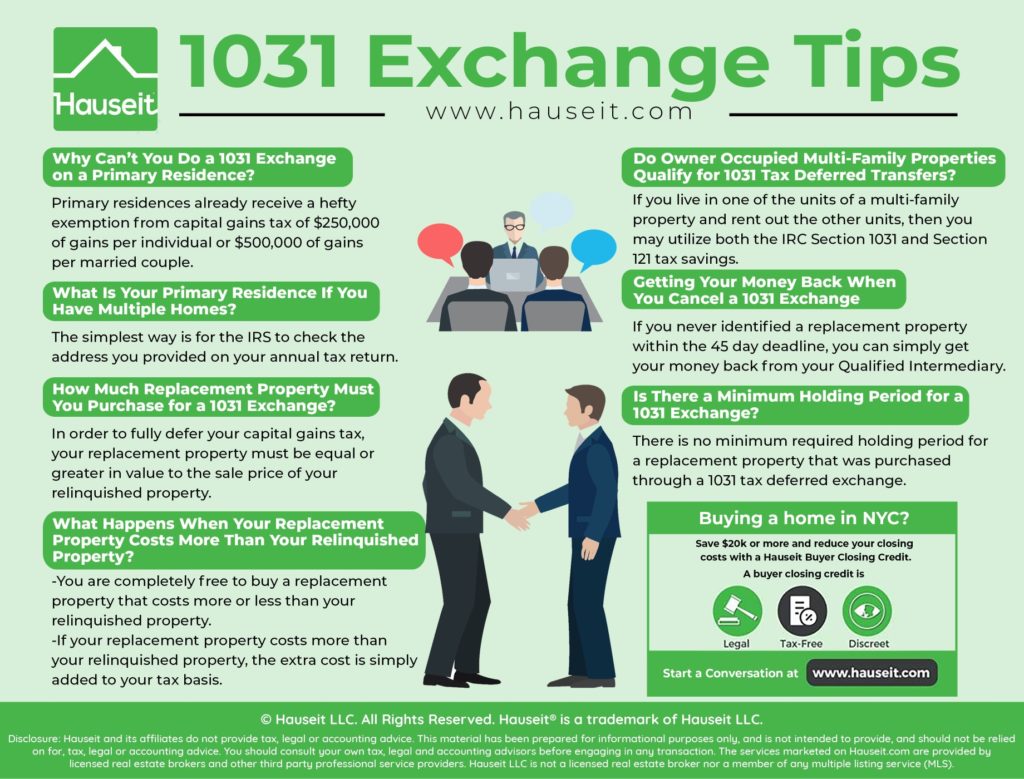

. While a Section 1031 exchange includes an exchange of properties a deferred exchange allows you to relinquish one property while afterward purchasing an additional or multiple like-kind replacement properties. However if M is allowed the automatic six-month extension for filing its tax return the. If as part of the exchange you also receive other not like-kind property or money you must recognize a gain to the extent of the other property and money received.

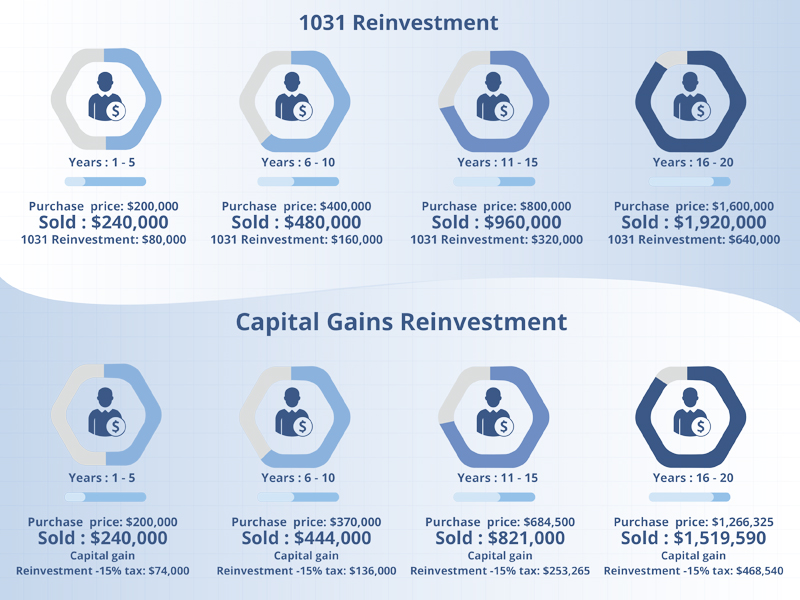

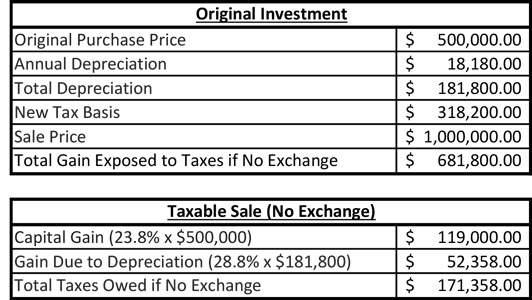

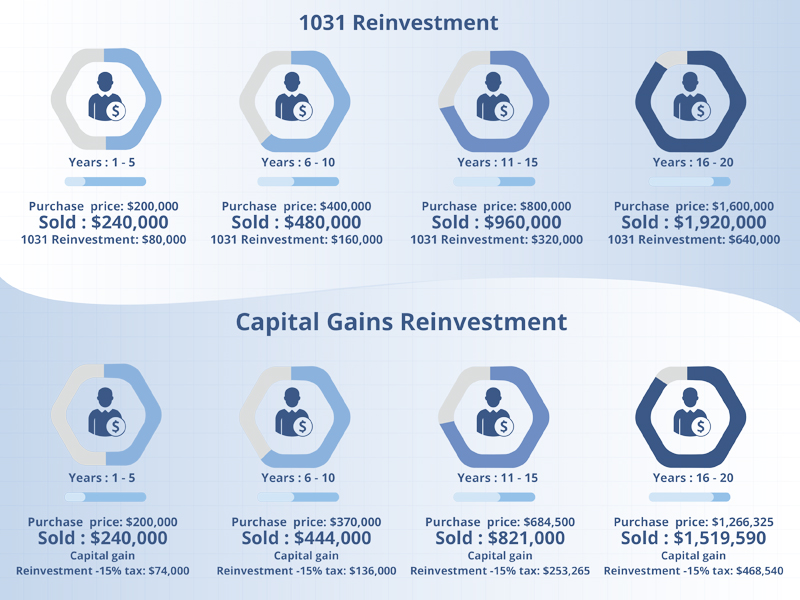

This transaction would lead to a profit of 200000 which would be subject to tax. A 1031 exchange also known as a Starker exchange or like-kind exchange is a property exchange rule that allows real estate investors to buy and sell investment properties while deferring payment on all or some incurred capital gains taxes at the time of the exchange. Internal Revenue Code IRC.

And exclude capital gains from the sale or exchange of an investment in such funds. The taxpayer pays 198000 less in tax using a Sec. Meaning all improvements and construction must be finished by the time the transaction.

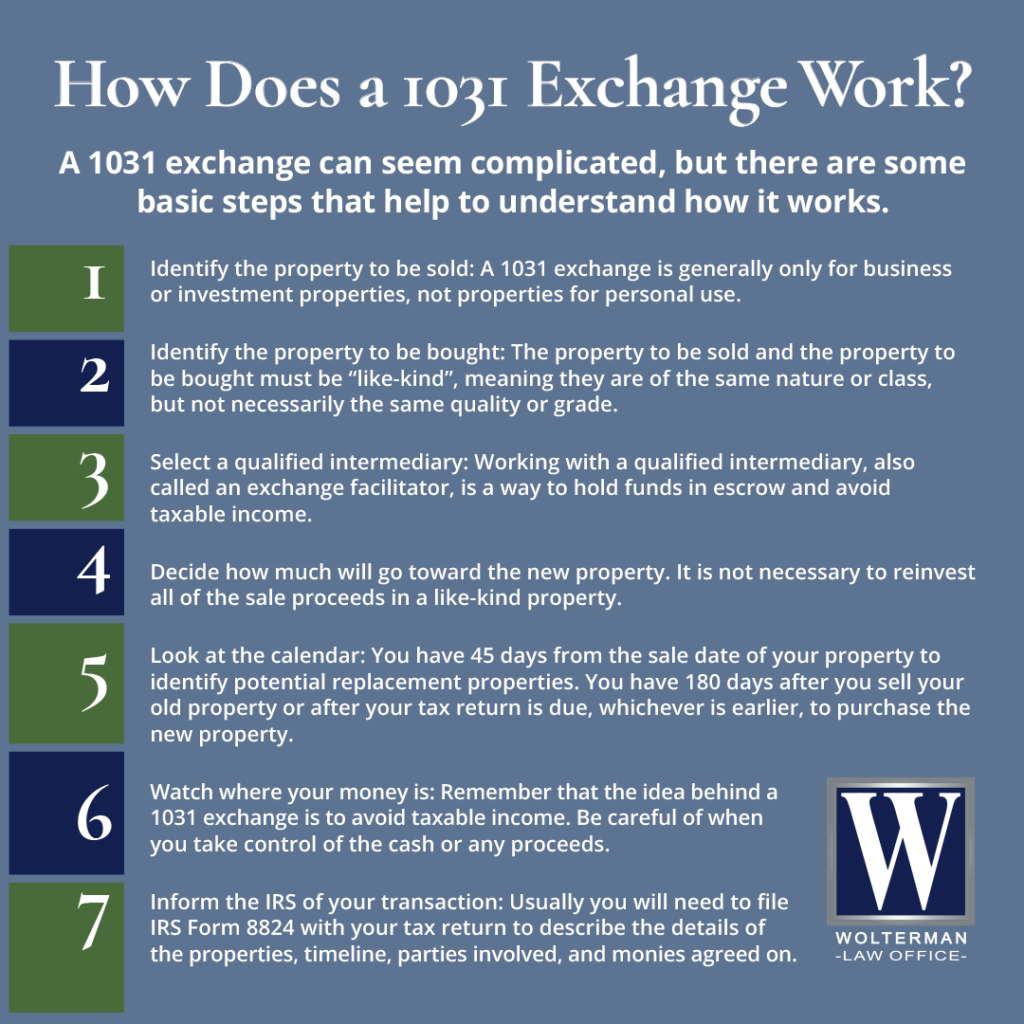

A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. A 1031 exchange or like-kind exchange is a method of exchanging investment properties that allows you to defer capital gains tax. 11031b-1 Receipt of other property or money in tax-free exchange.

A valid like-kind exchange has the benefit of deferred taxation meaning that the taxpayer does not bear a tax liability at the time of the exchange. 11031a-2 Additional rules for exchanges of personal property. Whiteacre and Greenacre were held for investment and are of like kind to Blackacre within the meaning of 1031.

Employing the 1031 tax-deferred exchange rules is to postpone the capital gain taxes. You can read more about how section 1031 and. Investment in the contract and basis are allocated according to cash value immediately prior to the exchange using the rules of sections 72 and 1031.

Exchange of other property services rendered gift inheritance. Boot is an old English word meaning something given in addition. There are seven.

These are the biggest pros of 1031 tax-deferred exchange rules and keep scrolling to learn all about the cons. On January 3 2005 B and C exchange Whiteacre and Greenacre respectively for all of A s interests in DST through a qualified intermediary within the meaning of 11031k-1g. The exchange period ends at midnight on March 15 1993 the due date for Ms Federal income tax return for the taxable year in which M transferred property X.

Ii The identification period ends at midnight on December 31 1992 the day which is 45 days after the date of transfer of property X. Break the 1031 exchange rules. 11031a-1 Property held for productive use in trade or business or for investment.

However the like-kind exchange is still the better option. The two most common forms are cash boot and mortgage debt boot. Drilling and delay rental clauses specify the manner in which early drilling can be deferred.

Real estate portfolio diversification. The main benefit of carrying out a 1031 exchange rather than simply selling one property and buying another is the tax deferral. Section 1031 of the Internal Revenue Code To IRSgov details how a 1031 exchange works.

Upon the purchase of the strip mall replacement property he holds it for 10-20 months as a way of proving his intent to hold the property thus qualifying for capital gains tax deferral. Yet this last. You cant recognize a loss.

If the California real property is part of a deferred like-kind exchange within the meaning of IRC Section 1031 the sale is exempt from withholding at the time of the initial transfer. However drilling cannot be deferred past the primary term of the lease without voiding the lease. 3 Types of Boot in a 1031 Tax-Deferred Exchange.

Less common is an other than real estate category often called personal property boot. Property acquired in a 1031 exchange is the same as the basis of the property exchanged decreased by any money the taxpayer receives and increased by any gain the taxpayer recognizes. California conforms to this change under the TCJA for exchanges initiated after January 10 2019.

Developers. This may be done for a specified period by the payment to lessors of delay rentals. Rules of Like-Kind Exchange.

For purposes of this section - 1 Intercompany transactions - i In general. Use of a like-kind exchange is appropriate in myriad situations. Under 1031a3 and 11031k-1b of the Income Tax Regulations.

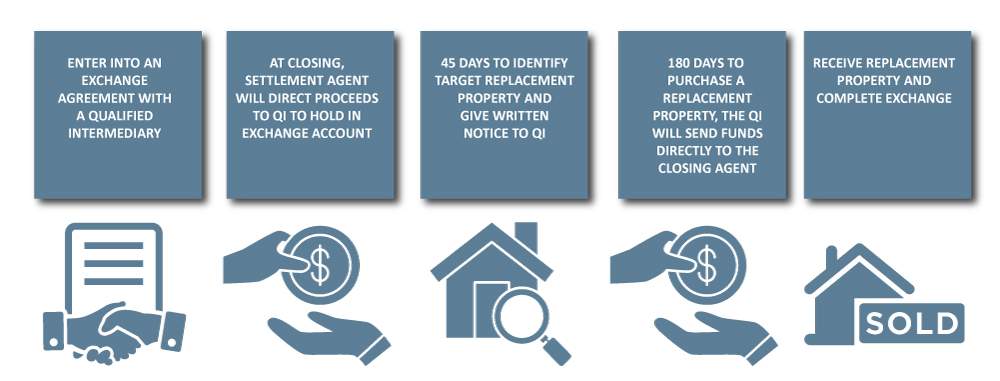

11031b-2 Safe harbor for qualified intermediaries. A does a 1031 exchange he can defer this tax by replacing the sold property with another property similar in nature and character with a 45-day and 180-day period as mentioned in the rules below. An exchange of a portion of an annuity contract into a new annuity contract is treated as a tax-free exchange under section 1035 of the Code.

Doing a 1031 exchange process he acquires another multifamily apartment or strip mall like-kind property of similar or higher value. However certain accounts have annual contribution limits and restrictions on the. A does not engage in a 1031 exchange.

The term 1031 exchange comes from Section 1031 of the US. The taxpayer recognizes the realized gain or loss when the like-kind property received is sold or disposed of in a. Under Section 1031 of the United States Internal Revenue Code 26 USC.

Exchange of a portion of annuity contract. 11031a-3 Definition of real property. Section 1031 and the regulations thereunder allow for deferred exchanges of property.

Referred to by its namesake IRS Code Section 1031 the bill was passed in 1921 to encourage active reinvestment by giving investors the ability to avoid taxation of ongoing investment property. However if the sellertransferor receives money or other property in addition to property that is a part of the like-kind exchange exceeding 1500 from the. In this case its in addition to like-kind property.

A deferred exchange is considerably more complicated but allows for more freedom. The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. Generally if you make a like-kind exchange you are not required to recognize a gain or loss under Internal Revenue Code Section 1031.

1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property a process known as a 1031 exchangeIn 1979 this treatment was expanded by the courts to include non-simultaneous sale and purchase of real estate a. HSA and individual retirement accounts IRA offer investors the opportunity to buy real estate tax-deferred meaning they can invest in real estate now and pay taxes on it later. 1031 exchange versus an outright sale a significant reduction from the 378870 in tax savings that would accrue from using a like-kind exchange under the current rules.

A 1031 exchange is a tax break. S is the member transferring property or providing services and B is the member receiving the property or services. However prior-law rules that allow like-kind exchanges of personal property still apply if one leg of a personal property exchange was completed as of December 31 2017 but one leg remained open on that date.

Essentially it allows an investor to defer the payment of federal income taxes typically incurred by selling an investment property so long as the profit from the property sale is used to purchase a like-kind propertyThe words like-kind refer to the nature or character of.

Real Estate Glossary Real Estate Terminology Real Estate Real Estate Articles Real Estate Agent

1031 Exchange When Selling A Business

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

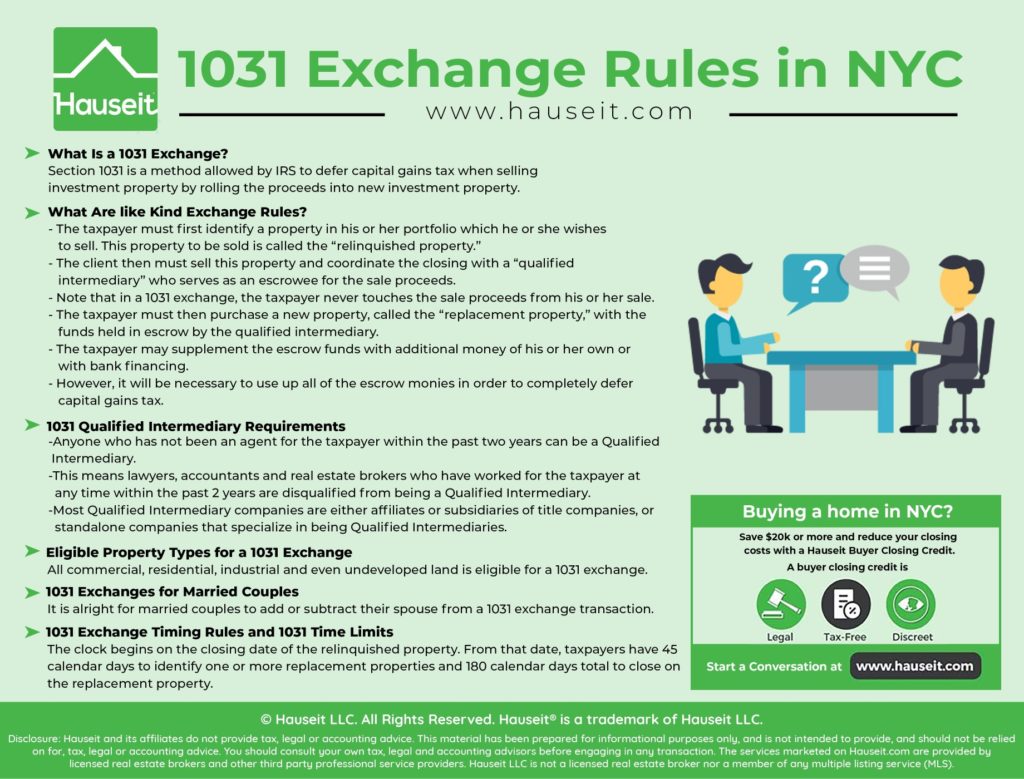

How To Do A 1031 Exchange In Nyc Hauseit New York City

How To Do A 1031 Exchange In Nyc Hauseit New York City

Like Kind Exchanges Of Real Property Journal Of Accountancy

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

1031 Exchange Services Ohio Business And Tax Lawyers

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

The Final Walk Through Explained For Nyc Nyc Finals Explained

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

1031 Exchange Explained What Is A 1031 Exchange

Are You Eligible For A 1031 Exchange